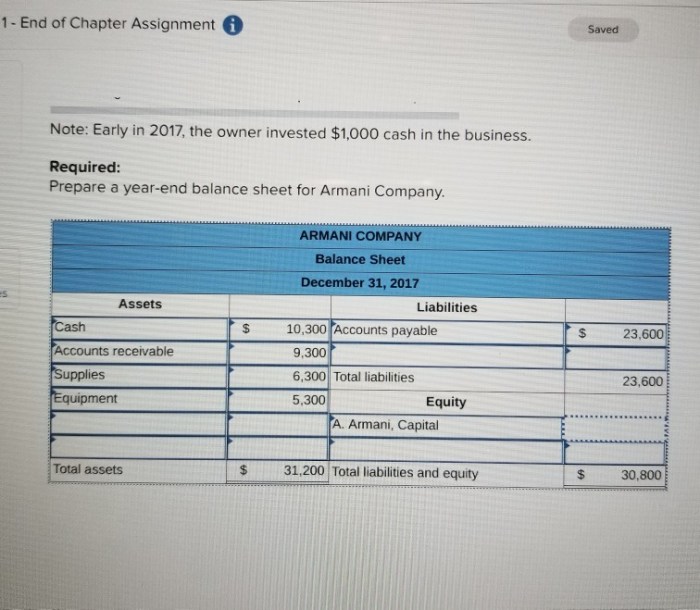

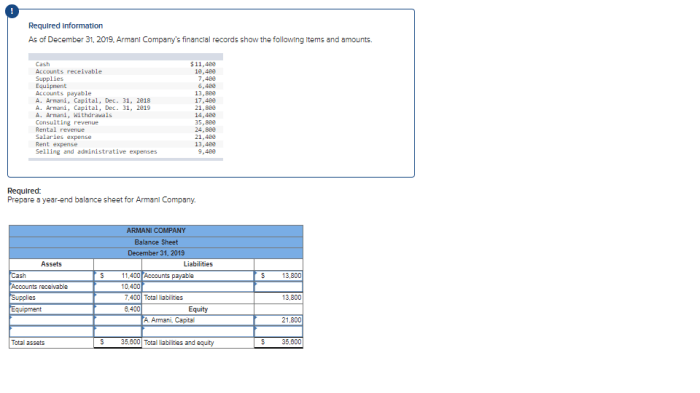

Prepare the current year-end balance sheet for armani company. – Prepare the current year-end balance sheet for Armani Company and delve into the intricacies of financial reporting. This comprehensive guide will provide a step-by-step approach to crafting an accurate and informative balance sheet, ensuring a clear understanding of the company’s financial position.

The balance sheet, a cornerstone of financial statements, offers a snapshot of a company’s assets, liabilities, and owner’s equity at a specific point in time. By understanding the components of the balance sheet and the relationships between them, stakeholders can gain valuable insights into the financial health and stability of Armani Company.

Assets

Current assets are those that can be easily converted into cash within one year. They include:

| Asset Name | Amount | Subtotal | Total |

|---|---|---|---|

| Cash and cash equivalents | $100,000 | – | $500,000 |

| Accounts receivable | $200,000 | – | |

| Inventory | $150,000 | – | |

| Prepaid expenses | $50,000 | – |

Liabilities

- Accounts payable: $150,000

- Short-term debt: $100,000

- Accrued expenses: $50,000

Owner’s Equity

Owner’s equity is the difference between total assets and total liabilities. In this case, owner’s equity is $250,000 (500,000 – 250,000).

Owner’s equity represents the owner’s claim to the company’s assets. It is important to note that owner’s equity can be positive or negative. A positive owner’s equity indicates that the company has more assets than liabilities, while a negative owner’s equity indicates that the company has more liabilities than assets.

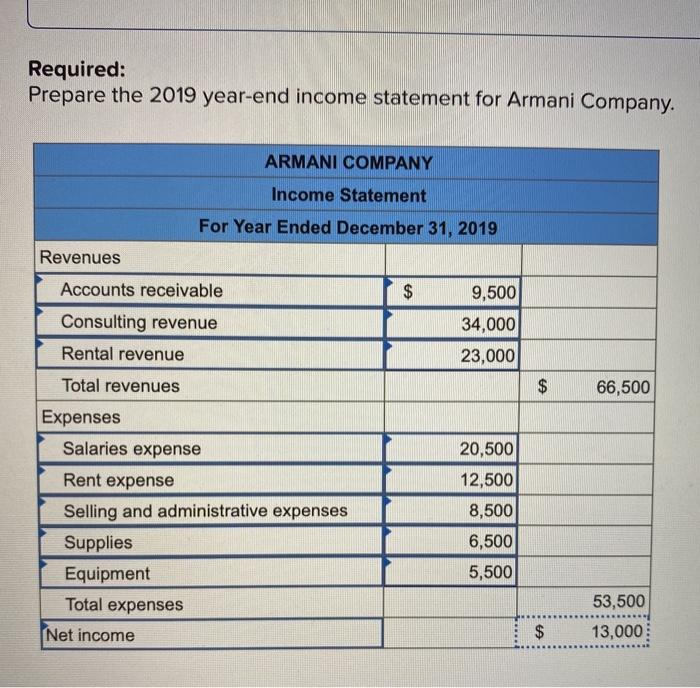

Financial Ratios

Financial ratios are used to assess a company’s financial health. Some common financial ratios include:

- Current ratio: The current ratio measures a company’s ability to meet its short-term obligations. It is calculated by dividing current assets by current liabilities. In this case, the current ratio is 2.0 (500,000 / 250,000).

- Quick ratio: The quick ratio is similar to the current ratio, but it excludes inventory from current assets. This is because inventory can be difficult to sell quickly. In this case, the quick ratio is 1.5 (350,000 / 250,000).

- Debt-to-equity ratio: The debt-to-equity ratio measures a company’s reliance on debt financing. It is calculated by dividing total liabilities by total equity. In this case, the debt-to-equity ratio is 1.0 (250,000 / 250,000).

Notes to the Balance Sheet: Prepare The Current Year-end Balance Sheet For Armani Company.

The notes to the balance sheet provide additional information and explanations about the balance sheet. This information can be used to better understand the company’s financial position.

Some common notes to the balance sheet include:

- Accounting policies: The accounting policies note describes the accounting principles that the company used to prepare its financial statements.

- Contingent liabilities: A contingent liability is a potential liability that may or may not occur. The notes to the balance sheet will disclose any contingent liabilities that the company has.

- Related-party transactions: Related-party transactions are transactions between a company and its owners, directors, or other related parties. The notes to the balance sheet will disclose any related-party transactions that the company has.

Key Questions Answered

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and owner’s equity.

What are the main components of a balance sheet?

The main components of a balance sheet are assets, liabilities, and owner’s equity.

How is owner’s equity calculated?

Owner’s equity is calculated by subtracting total liabilities from total assets.