Compound interest earned on a savings account everfi offers a unique opportunity to grow your wealth over time. This comprehensive guide will delve into the intricacies of compound interest, savings accounts, and the strategies for maximizing your earnings.

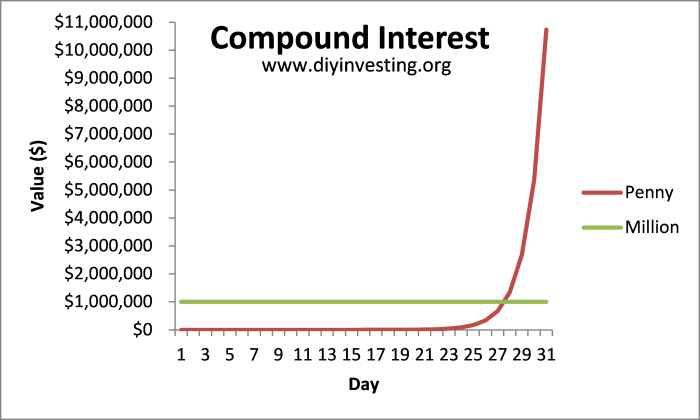

Understanding the concept of compound interest is crucial. It allows your interest to earn interest, leading to exponential growth. We will provide detailed calculations and examples to illustrate how compound interest works.

Compound Interest

Compound interest is a type of interest that is calculated on both the principal amount and the accumulated interest from previous periods. This means that the interest earned in each period is added to the principal, and the interest earned in subsequent periods is calculated on the new, larger principal amount.

For example, if you deposit $1,000 into a savings account with a 5% annual interest rate, you will earn $50 in interest in the first year. In the second year, you will earn interest on both the original $1,000 principal and the $50 interest earned in the first year, for a total of $52.50 in interest.

This process continues in each subsequent year, resulting in an exponential growth of the account balance.

Factors Affecting Compound Interest

- Principal amount:The larger the principal amount, the more interest you will earn.

- Interest rate:The higher the interest rate, the more interest you will earn.

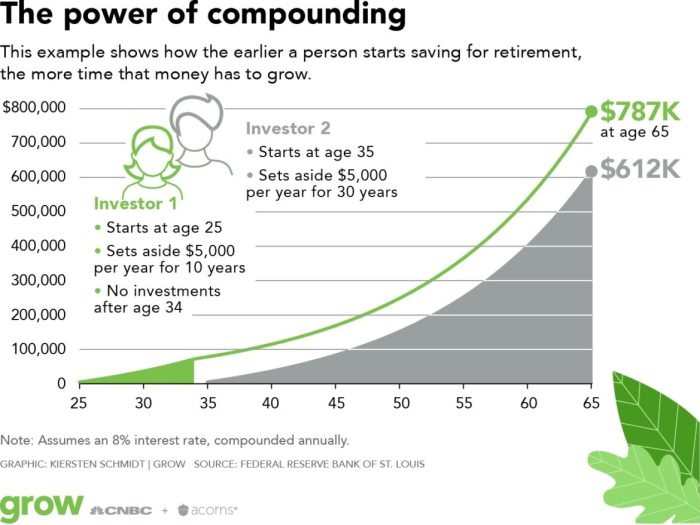

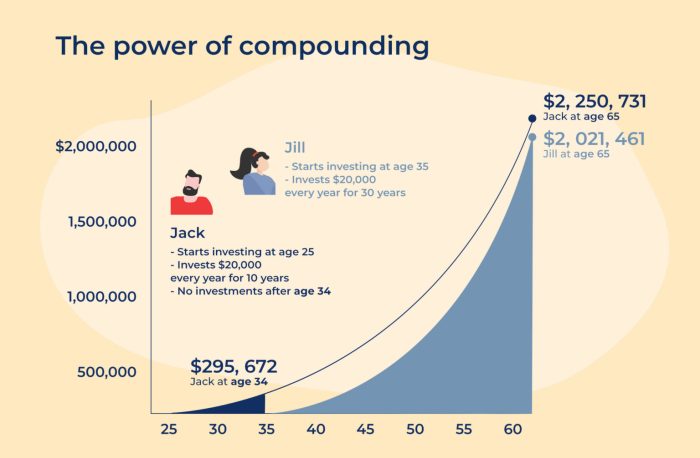

- Time:The longer you leave your money in the account, the more interest you will earn.

- Frequency of compounding:The more frequently interest is compounded, the more interest you will earn.

Savings Accounts

A savings account is a type of deposit account held at a financial institution that pays interest on the money deposited. Savings accounts are typically used to save money for future goals, such as a down payment on a house or a child’s education.

Interest on savings accounts is usually compounded monthly or quarterly. This means that the interest earned in each period is added to the principal, and the interest earned in subsequent periods is calculated on the new, larger principal amount.

Types of Savings Accounts

- Passbook savings accounts:Passbook savings accounts are traditional savings accounts that use a passbook to record transactions.

- Statement savings accounts:Statement savings accounts are savings accounts that provide monthly statements that show all transactions.

- Money market accounts:Money market accounts are savings accounts that offer higher interest rates than traditional savings accounts, but they also have higher minimum balance requirements.

Earning Interest

The amount of interest you earn on a savings account over time depends on the following factors:

- The principal amount

- The interest rate

- The time period

- The frequency of compounding

- A is the future value of the investment

- P is the principal amount

- r is the annual interest rate

- n is the number of times per year that interest is compounded

- t is the number of years

- Shop around for the best interest rates.There are a number of different savings accounts available, so it’s important to compare interest rates before you open an account.

- Keep your balance as high as possible.The more money you have in your savings account, the more interest you will earn.

- Consider a long-term savings plan.The longer you leave your money in the account, the more interest you will earn.

- Be aware of fees.Some savings accounts have fees, such as monthly maintenance fees or withdrawal fees. Make sure you understand the fees associated with your account before you open it.

- You will earn more interest.The longer you leave your money in the account, the more interest you will earn.

- You will be less likely to spend the money.If you have a long-term savings goal, you are less likely to spend the money in your savings account.

- You will be more financially secure.Having a long-term savings plan will help you to be more financially secure in the future.

You can use the following formula to calculate the amount of interest you will earn on a savings account over time:

A = P(1 + r/n)^(nt)

Where:

Growth of a Savings Account Balance Over Time

| Year | Balance |

|---|---|

| 0 | $1,000 |

| 1 | $1,050 |

| 2 | $1,102.50 |

| 3 | $1,157.63 |

| 4 | $1,215.51 |

| 5 | $1,276.28 |

Maximizing Earnings: Compound Interest Earned On A Savings Account Everfi

There are a few things you can do to maximize your earnings on a savings account:

Benefits of Long-Term Saving, Compound interest earned on a savings account everfi

Detailed FAQs

What is the formula for calculating compound interest?

A = P(1 + r/n)^(nt)

Where:

A = Final amount

P = Principal amount

r = Annual interest rate

n = Number of times interest is compounded per year

t = Number of years

How often should I compound interest?

The more frequently interest is compounded, the faster your money will grow. Daily or monthly compounding is ideal.

What are the benefits of long-term saving?

Long-term saving allows compound interest to work its magic. The longer you save, the greater the potential growth.